This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. For full details on the cookies used on our website, please visit our Cookies Policy page.

Fees for the 2025/26 academic year

Fees for all of our degree courses are £9,535 per year for Home students, and £17,000 per year for International Students.

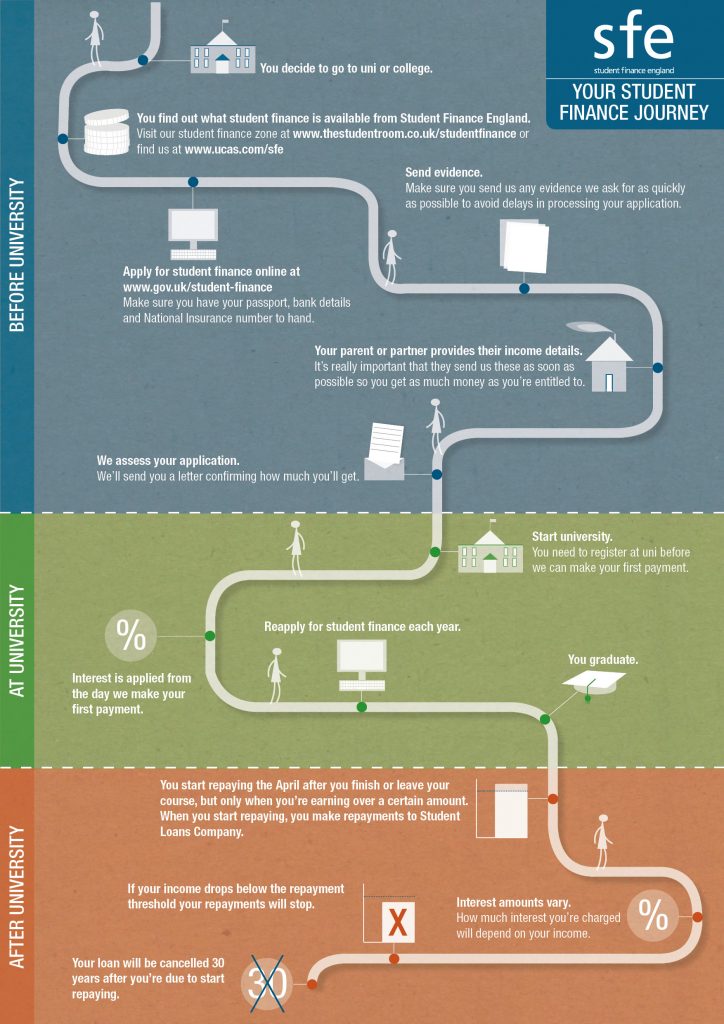

As an approved provider of Higher Education, all Futureworks degree courses are eligible for funding from the Student Loans Company. This means that you can apply for funding for each year of your course, making it easier to manage your finances while you study.

If you’re not eligible for funding or don’t want to get a loan, we offer a range of payment options to help you manage the cost of your education. Our payment plans allow you to spread the cost of your fees over the course of your studies, while our upfront payment option allows you to pay your fees in full at the start of your course.

We understand that managing your finances while you study can be stressful, and we want to make it as easy as possible for you to pursue your creative dreams. If you have any questions about funding or payment options, please don’t hesitate to get in touch with us on [email protected]. We are here to help you every step of the way.

Tuition Fee Loans

A tuition fee loan covers the cost of your course fees and is paid directly to Futureworks.

Your eligibility for a tuition fee loan depends on your previous education, and your nationality or residency status. More information about eligibility for funding can be found at gov.uk/student-finance/who-qualifies.

Each of the UK nations and islands has its own funding body – you should apply to the funding body of the nation where you normally live, not the nation you will be studying in (unless these are the same). The different UK funding bodies are:

England – Student Finance England

Apply online for Student Finance

Wales – Student Finance Wales

Student Finance Wales – how and when to apply

Northern Ireland – Student Finance Northern Ireland

Scotland – Student Awards Agency Scotland

Funding Information for Scottish Students

Channel Islands:

Isle of Man – Isle of Man Department of Education and Children

Applications for Student Finance usually open in March. It can take up to six weeks for your application to be processed, and sometimes even longer depending on how much evidence is required and how busy it is.

We recommend you apply for Student Finance as early as possible to avoid any delays in your funding. You don’t need to have a confirmed place on a course to apply, you can just enter the details of the course and institution you expect to be attending. If this changes at any time you can let them know.

You should make sure you have the following ready when you decide to apply:

Institution

Futureworks Training Limited

Course details

Below is a list of the full titles of each of our degree courses, and their corresponding SLC course codes:

- BA (Hons) Game Art – 691314

- BA (Hons) Games Design – 538206

- BA (Hons) Digital Animation with Illustration – 580357

- BA (Hons) Independent Filmmaking – 711360

- BA (Hons) Post Production for Film and TV – 691313

- BA (Hons) Visual Effects – 593332

- BSc (Hons) Audio Engineering and Production – 566238

- BA (Hons) Music Production – 538203

- BSc (Hons) Game and Interactive Audio – 728054

A working email address

We recommend you don’t use your school/college email as you may lose access to this once you’ve left.

An in-date UK passport

If you don’t have an in-date passport you will need to send off original copies of other documents, such as a birth certificate.

Maintenance Loans

Maintenance Loans are paid directly into your bank account and are intended to cover your additional expenses such as accommodation, food and travel.

The amount of Maintenance Loan you’re eligible for depends on where you live in the UK, whether you’ll be living at home, and your household income. You can find out more information about how much you could be entitled to here gov.uk/student-finance-calculator.

As the loan is means tested you will need to provide evidence of your household income and may need your parent/guardian/partner to submit some information too.

As well as income they may also look at things like the number of dependents parents or partners have.

If someone in your household is asked to submit evidence of income it is important that they do so, as otherwise applications will not be completed, and funding cannot be received.

Before you apply for a maintenance loan, check that you have:

A bank account in your own name

Maintenance loan payments are made directly to you and will only be paid into an account in your name.

Household income information

Means-tested loans will look at the income of your parents/guardians or partner, so you will need their help when it comes to applying.

Additional Support

As well as tuition fee and maintenance loans, there may be other types of financial support available to you depending on your circumstances. We have included some of the most commonly used options here, but it is always worth researching what is available.

The types of additional support available to you may vary depending on where you normally live so it’s worth contacting your funding body if you’re unsure about what you might be entitled to.

Disabled Students’ Allowance

Disabled Students’ Allowance (DSA) is support to cover the study-related costs you have because of a mental health problem, long term illness or any other disability.

gov.uk/disabled-students-allowance-dsa

Adult Dependants Grant

You can apply for an Adult Dependants’ Grant if you’re a full-time undergraduate student and have an adult who depends on you financially.

gov.uk/adult-dependants-grant/eligibility

Parents’ Learning Allowance

This helps with course-related costs if you have dependent children.

How much you can get depends on your household income, which is your income and the income of your partner and any dependants.

gov.uk/parents-learning-allowance

Childcare Grant

You can apply for the Childcare Grant (CCG) to help with the cost of childcare during your studies.

gov.uk/childcare-grant/eligibility

Support for Care Experienced Students

Care Leavers can apply for full support from Student Finance England as an independent student without providing any information about their household income.

You will be asked to send evidence that shows you were looked after, or have been given accommodation by, your local authority.

Support for Independent or Estranged Students

https://www.ucas.com/finance/student-finance-england/finance-independent-students

Financial Support at Futureworks

Futureworks provides a variety of financial support options for students where funding is a barrier to participation, contribution and attainment. This includes entrance bursaries, scholarships and emergency hardship loans. You can find out more about what’s available here.

Paying Your Fees Privately

Some students aren’t eligible for Student Finance, or chose not to use it for other reasons. In this case, you can pay the fees yourself or have a nominated person pay them on your behalf.

We work with each student to devise the most appropriate payment plan for their tuition fees, which is usually either in monthly or termly instalments via direct debit. If you think you might need to arrange a payment plan for your course fees you can contact us at [email protected] and we will be happy to discuss this with you.